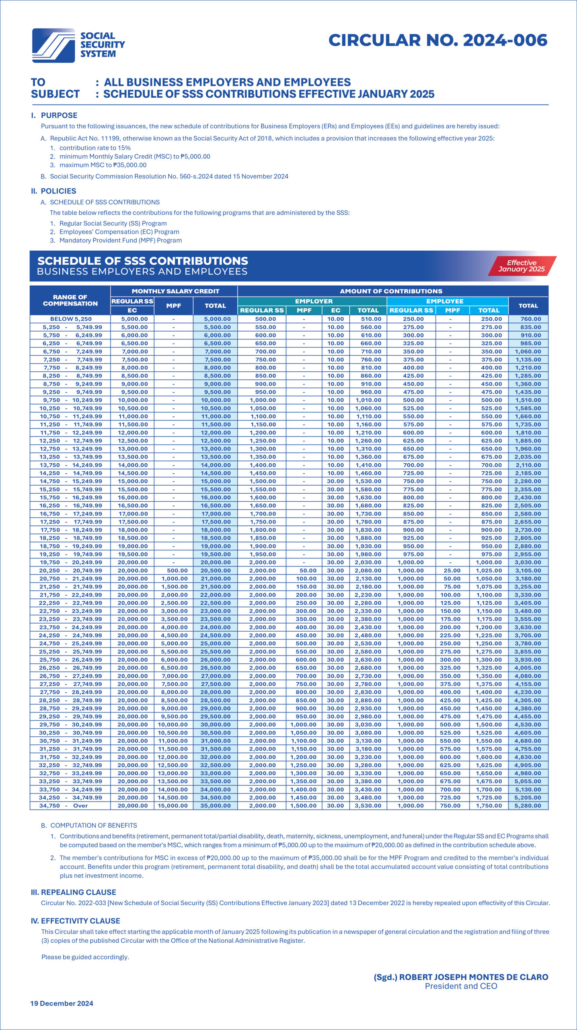

Effective January 1, 2025, the Social Security System (SSS) in the Philippines increased its contribution rate from 14% to 15%. This adjustment applies to all members, including mandatory and voluntary contributors. The increase is part of the gradual adjustments mandated by the Social Security Act of 2018, which stipulates a 1% contribution increase every two years, starting from 12% in 2019, to strengthen the pension fund’s sustainability.

Source: GMA Network

Under the new rate, the contribution is shared between employers and employees, with employers contributing 10% and employees contributing 5%. Self-employed, voluntary, and non-working spouse members are responsible for the full 15% contribution. The updated contribution schedule is detailed on the SSS official website: Social Security System

–

More information, www.linkcompliance.com

Email: info@linkcompliance.com

–

Singapore | Malaysia | Indonesia | USA | China (Shanghai, Beijing, Shenzhen, Hong Kong, Taiwan) | Vietnam | Japan | Germany | Turkey | Philippines