Market overview of Japan marketing recent months

In 2024, the Japanese yen hit its lowest value in 34 years, triggering a series of effects on the country’s economy. A weaker yen benefits large Japanese companies that work internationally as it makes their profits from overseas worth more when converted back into yen. Moreover, with the depreciation, it fostered a surge in tourism by increasing the purchasing power of incoming travellers. This was especially noticeable in March because the cherry blossom season started early, drawing even more visitors.

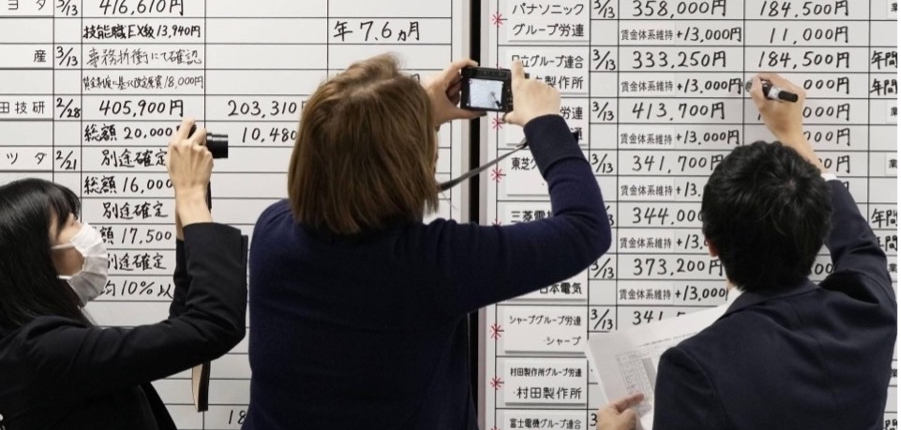

While a weak yen can result in higher costs for imported essentials like energy and food, negatively affecting consumers, there are countermeasures in place. Japan’s largest companies took proactive steps by agreeing to substantial wage increases of 5.28% for the year 2024, the most significant raise in 33 years (Source: reuters.com). These wage hikes, surpassing inflation rates, have the potential to bolster consumer confidence and stimulate higher spending.

Setting up a new business in Japan: The Challenges

Bureaucratic Start-up Challenges

Starting a business in Japan can be quite exhausting because there are many bureaucratic procedures to follow before a company can start to operate. One will need to interact with many government offices such as the District Tax Office, the Legal Affairs Bureau, the District Tax Office, the Labor Standards Inspection Office, to name a few, and others before a company can move on to complete other processes.

Language

Language poses a significant barrier for starting a business in Japan due to legal documentation, communication with authorities, negotiations, cultural understanding, and marketing. Non-fluency in Japanese complicates legal procedures, communication with government offices, negotiations, and understanding Japan’s cultures. Many international businesses struggle to overcome the language barrier, which acts as a significant obstacle. Only 13-30% of the Japanese population speak any level of English (Source: myclasstracks).

Banking

Japan’s banking system emphasizes long-term relationships. This may pose challenges for new businesses. Companies often have longstanding relationships with banks, which may even become shareholders. Limited English and overseas support make establishing connections difficult, with no guarantee of accessibility for overseas transactions.

Social Insurance

In Japan, there is a complex system of social and labour insurance that companies are legally required to comply with. This includes various types of insurance like workers’ accident compensation, employment, health, nursing care, and employees’ pension insurance. When a company is first established or starts hiring employees, it must enrol in these insurance programs. Companies need to submit the specific forms for social and labour insurance to the relevant authorities, along with providing annual reports if necessary.

Tax system

Foreign investors face challenges navigating sector-specific regulations and conditions attached to tax incentives, adding complexity to investment decisions and operations. The Japanese tax system is a victim of the country’s love of bureaucracy. The corporate tax system can soak up approximately 130 hours of management time, with 19 payments required annually (as of 2020 World Bank data). Corporate tax rates stand at 30%, with a line of other levies also requiring consideration.

Invoice system

As of October 1, 2023, Japan has implemented a new mandatory consumption tax invoicing system called the “Qualified Invoice System”. The Qualified Invoice System affects most taxable businesses operating in Japan because it requires the issuance and retention of qualified invoices to receive purchase tax credits. This Qualified Invoice System means that only registered businesses can issue invoices called “qualified invoices.” If a business isn’t registered, they can’t issue these invoices. So, if the seller is not registered, the buyer will not be able to receive a tax invoice and will not be able to receive purchase tax credits. This could lead to the buyer facing a heavier tax burden.

Recent trends of businesses expanding in Japan

Despite all the challenges mentioned above, there are definitely opportunities awaiting to expand businesses in Japan’s market. To overcome these challenges, companies can try to explore partnerships with local recruitment agencies or HR consultants to leverage their expertise and networks. This is essential for developing a recruitment strategy aligned with the company’s expansion plans in Japan. With this move, it can help a business to navigate the Japanese labor market and identify qualified candidates.

“Ranked among the world’s largest economies, Japan stands as a beacon of innovation, attracting businesses seeking global expansion. With a highly educated population, a thriving economy, and a rich cultural heritage, Japan offers numerous opportunities for businesses across a range of industries.”

Hiring your first headcount in Japan

In a hiring process, it is essential to do the market research and understand the challenges before setting goals to align the ideal candidate with the right job role.

Recruiting in Japan requires a deep understanding of local customs and acknowledges the tough challenge of finding the best talent in a competitive market. Finding the right people to start a business in Japan is tough because of language differences, cultural differences, how companies are set up there, what skills people have, and the fact that there might not be enough of the right talent available.

Hiring your first employee in Japan involves setting targets aligned with cultural norms, skill requirements, and competitive salaries. Ensure legal compliance and assess language proficiency to attract candidates who fit your company culture and meet job expectations.

Navigating the process of hiring your first employee in Japan also entails establishing strong communication channels with local stakeholders and understanding the intricacies of employment regulations. Thus, fostering relationships with recruitment agencies or local networks can provide invaluable insights and connections to streamline the hiring process and identify top talent effectively.

Employment regulations you need to know

Working Overtime

According to the Japanese Labor Standards Act, only a full-time employee can work for 8 hours a day and 40 hours a week in total. The law also stipulates that anything above these limitations is considered overtime and requires extra pay. An employer can require their employees to work longer than the statutory maximum hours, only if they enter into a labor-management agreement (known as an “Article 36 Agreement”). The “36 agreement” is usually in the form of a standard one-page contract that is stamped by the company and its workers’ representative and filed with the local labor office.

Harassment Law

The Japanese government has published numerous guidelines regarding workplace harassment. While harassment can occur in any country, it is particularly sensitive and important in Japan, and foreign companies must be aware and comply.

Japanese employers are required to address workplace harassment, which includes sexual harassment and “power harassment” (“pawahara”). As of May 2019, there are legal rules in Japan for power harassment, with such measures becoming mandatory for large employers from June 2020 and for small and medium-sized enterprises from April 2022.

Taking Vacations

Full-time employees typically receive 10 to 20 vacation days, depending on their years of service. After the initial 6 months with 80% attendance, employees become eligible for 10 days of vacation. Employers are required to ensure that employees with ten or more vacation days take at least five days per year. Employers who fail to apply this measure face penalties.

Time Sheet

Recording and managing employee working time accurately is an important basic practice for many reasons, hence time sheet is important in Japan. Some foreign companies do not accurately use timesheets and/or properly manage working hours and overtime in accordance with Japanese Labour Law.

How LC Recruitment + EOR Solutions Can Help You in Japan

At Link Compliance, we have the local expertise to guide you through the challenging procedures of starting up a new business in Japan. Whether you are looking to establish a presence in Japan or simply seeking to optimize your existing Japanese operations, with the right partner to collaborate, a new business can commence operations as soon as tomorrow! Japan with ease, and secure the best-fit candidates for your company’s success.

Our Services

Employer of Record (EoR)

Link Compliance offers comprehensive Employer of Record (EoR) solutions tailored for companies aiming to establish their presence in Japan quickly and seamlessly. Leveraging our expertise in local regulations and employment practices, we streamline the process, enabling businesses to commence operations within a mere 24 hours. Our EoR services encompass all aspects of compliance, from hiring and payroll to tax obligations, relieving our clients from administrative burdens while ensuring full legal adherence.

We do not upsell our services. We ensure your business can effortlessly onboard employees compliant with local laws, without the burden of navigating complex tax systems or managing international payroll. With the right mandatory documents, we can onboard your employee as soon as on the next day.

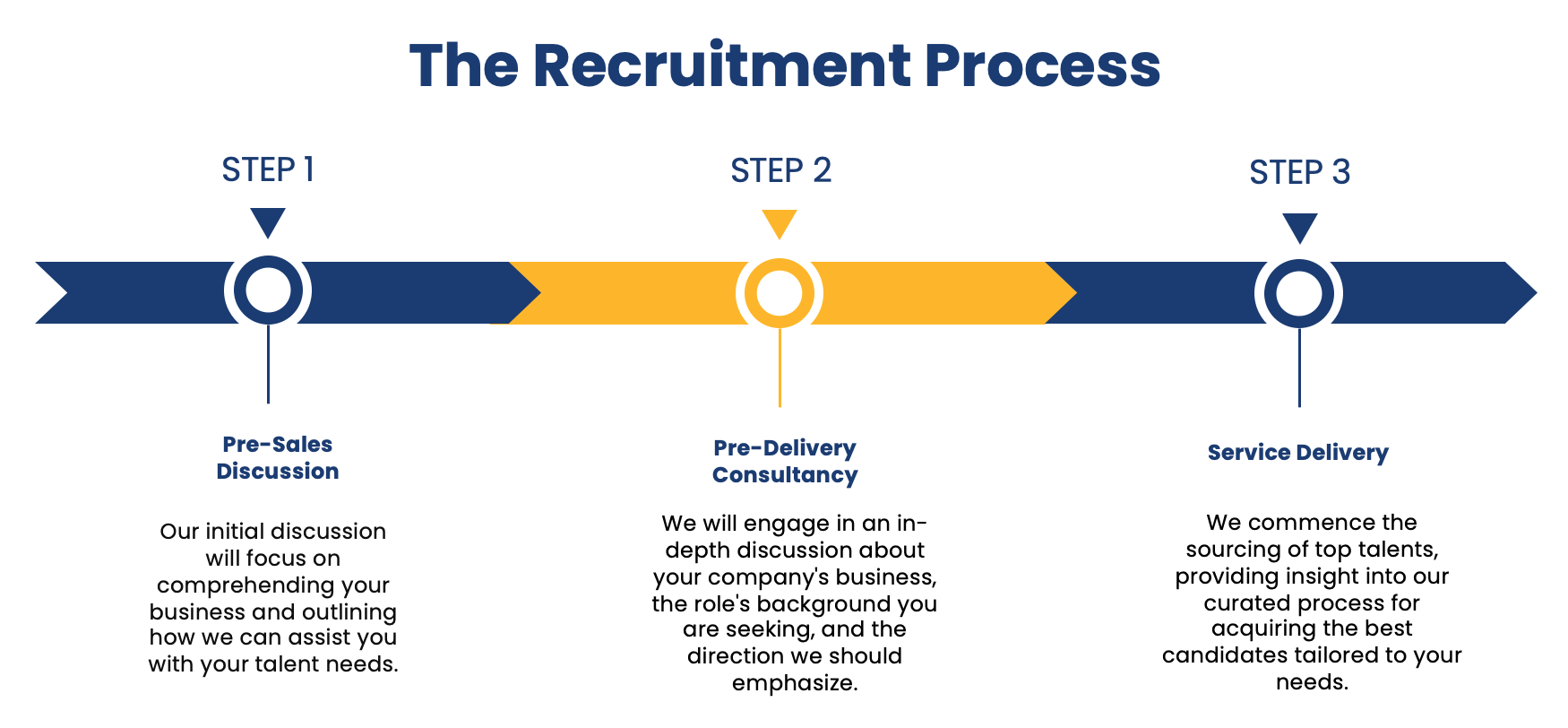

Recruitment

With our innovative, technology-driven recruitment methodology, we power businesses by connecting them with high-quality passive talents efficiently and effectively. We have a strong network of our local teams supplemented by partners allowing us to employ almost anyone anywhere.

From sourcing candidates to conducting interviews and handling documentation, our team manages every aspect, saving our clients time and resources. With Link Compliance as your recruitment partner, navigate the complexities of hiring in Japan with ease, and secure the best-fit candidates for your company’s success.

Global expansion made easy with Link Compliance

Skip the legal setup hassles and complex hiring procedures for rapid market penetration with only one service fee. Talk to our Japan’s representative:

Email: kl@linkcompliance.com

Website: www.linkcompliance.com

–

Singapore | Malaysia | China | Indonesia | Taiwan | USA | Vietnam | Japan | Hong Kong | Germany | Turkey